This  75chapter provides an overview of the budgetary process followed in the allocation of funds to the judiciary, a

comparative analysis of allocation by states on the judiciary and other social sectors, and statistical analysis

of judicial expenditure across different states.

75chapter provides an overview of the budgetary process followed in the allocation of funds to the judiciary, a

comparative analysis of allocation by states on the judiciary and other social sectors, and statistical analysis

of judicial expenditure across different states.

Budgeting Process

A study of the budgeting process followed by an organisation reveals much about its functioning, its

priorities, and objectives. And the judiciary is no exception.

The Supreme Court’s budget is prepared by its Registrar General, and is

forwarded by the union government Law Ministry to Ministry of Finance. This is also the practice followed by the

High Courts and state governments. The High Court has the additional responsibility of preparing budgets for

lower courts within its jurisdiction in the state (other than tribunals set up by the central government).

Officials at the Registry of the High Court of Karnataka and the Ministry of Law and Parliamentary Affairs of

the government of Karnataka, whom I interviewed, stated that budgets received from the judiciary are usually not

subjected to debate or discussion, and allocations are made for most items of expenditure.

However, practices followed in preparing the budget are rudimentary, as

is made clear from a policy document prepared by the National Court Management System Committee (NCMSC)

appointed by the Supreme Court:

In Taluka Courts, District Courts and High Courts, experience shows that the clerical staff

picks up demands as were made in the earlier years for funds and grants and the same is forwarded to the  76Government by taking

signature of the Judges in the Districts or Registrar General at the level of High Court. Most of the Judicial

Officers are not proficient in the art of planning and preparation of Budgets so that the Budget meets the

requirements for the next year and is neither excessive nor short. Need of expert assistance at these levels is

matter of consideration.1

76Government by taking

signature of the Judges in the Districts or Registrar General at the level of High Court. Most of the Judicial

Officers are not proficient in the art of planning and preparation of Budgets so that the Budget meets the

requirements for the next year and is neither excessive nor short. Need of expert assistance at these levels is

matter of consideration.1

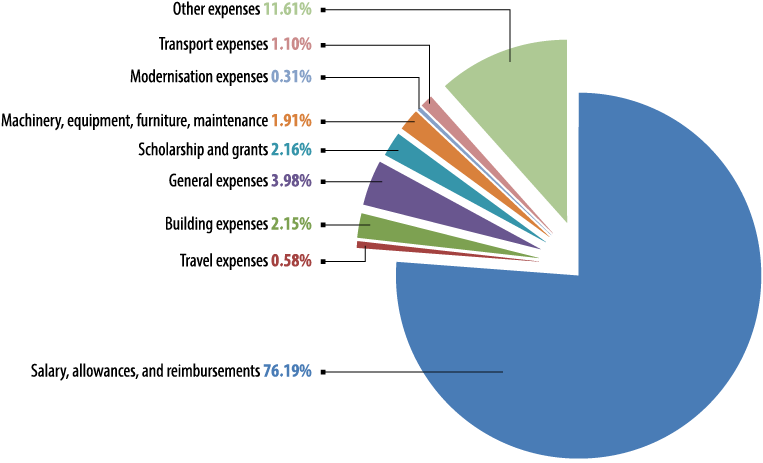

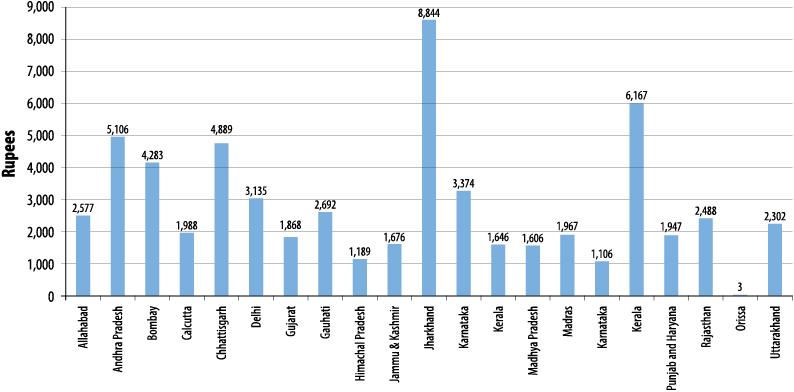

About 70–80 per cent of the state’s expenditure on the judiciary is incurred towards cost of manpower. As an illustration, see Figure 1, which gives details of

expenditure incurred by the government of Karnataka on the judiciary for financial year 2014–2015, categorised

based on the nature of expenses. Salary and allowances make up 76 per cent of the total expenditure.2 Therefore, the bulk of the budget, and the time

taken in its preparation is taken up by this item.

FIGURE 1. Expenditure towards Administration of Justice by the Karnataka

Government

Source: Annual Financial Statements of the Karnataka Government.

Analysis of Budgetary Allocation

There is no consensus on how the quantum of budgetary allocation to the judiciary should be

evaluated. The Supreme Court and the Law Commission have, in their reports, compared allocation to the judiciary

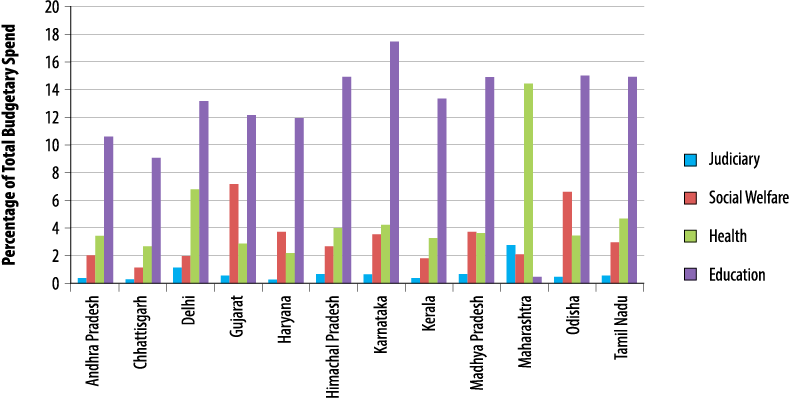

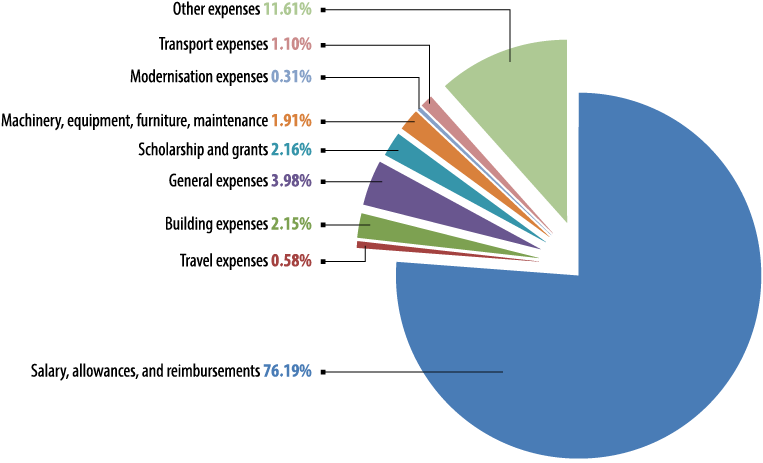

with allocation to the social welfare, health, and education sectors. Figure 2 shows a comparison between

expenditure on the judiciary and expenditure on other social sectors (as a percentage of total budgetary

expenditure) in a few select states. It is clear that expenditure on judiciary is much lower than that on social

and welfare sectors.

77FIGURE 2. Comparison of Budgetary Allocation amongst

Social Sectors by States

77FIGURE 2. Comparison of Budgetary Allocation amongst

Social Sectors by States

Source: ‘NCMSC 2012. National Court Management System: Policy and Action Plan. New

Delhi: Supreme Court of India, p. 26.

Note: Average expenditure on judiciary for the years 2007 to 2011 has been considered.

The 127th report of the Law Commission of India had highlighted, as

early as in 1988, the poor quality of infrastructure with which the courts have to make do in their functioning.

It remarked, ‘The administration of justice is not regarded as part of the developmental activity and therefore

not provided through the five year or annual plans. Justice is thus a non-plan expenditure.’3

Grants

In light of the concern over low budgetary allocation to the judiciary, the 13th Finance Commission

awarded4 a special grant of Rs 5,000 crores over a period of

five years (2010–2015) to both the union and state governments to be utilised for the following purposes:

1. Operation of morning/evening/special shift courts

2. Establishing alternative dispute resolution (ADR) centres and training of

mediators/conciliators

3. Lok Adalats

4. Legal aid

5. Training of judicial officers

6. State judicial academies

7. Training of public prosecutors

8. Creation of posts of court managers

9. Maintenance of heritage court buildings

A summary of the funds allocated, released, and ultimately used, for various schemes under the 13th

Finance Commission, is set out in Table 1.

78TABLE 1. Summary of Funds Allocated,

Released, and Utilised under 13th Finance Commission

78TABLE 1. Summary of Funds Allocated,

Released, and Utilised under 13th Finance Commission

|

Operation of morning/evening courts/shift courts

|

2,500

|

850.49

|

34

|

237.93

|

10

|

|

Lok Adalats/legal aid

|

300

|

120.36

|

40

|

67.89

|

23

|

|

Training of judicial officers

|

250

|

151.05

|

60

|

110.37

|

44

|

|

Training of public prosecutors

|

150

|

78.16

|

52

|

52.45

|

35

|

|

Maintenance of heritage court buildings

|

450

|

198.93

|

44

|

106.03

|

24

|

|

State judicial academies

|

300

|

171

|

57

|

123.02

|

41

|

|

ADR centres/training to mediators

|

750

|

391.21

|

52

|

272.1

|

36

|

|

Court managers

|

300

|

106.73

|

36

|

40.37

|

13

|

|

Total

|

5,000

|

2,067.93

|

41

|

1,010.16

|

20

|

Source: Department of Justice, Ministry of Law and Justice. 2015. ‘Thirteenth Finance Commission

(TFC) Award (Status, as on 31st March, 2015)’, available online at http://doj.gov.in/sites/default/files/TFT-Award-Status-31.03.2015.pdf

(accessed on 4 April 2016).

Note: Figures are as of 31 March 2015.

As can be seen from the above, at the end of the five-year period, funds of Rs 1,010 crores were

ultimately utilised against the initially allocated amount of Rs 5,000 crore, a mere 20 per cent. Further

analysis is required to identify the reasons for such abysmally low levels of funds utilisation, which is

outside the scope of this chapter.

However, the 14th Finance Commission has

dispensed with most centrally sponsored schemes and special grants, of which the grant to judiciary is also one.

Therefore, the onus of providing additional funding to meet the requirements of the judiciary is now squarely on

the state governments. This is amply clear from the recommendation of the 14th Finance Commission to the

proposal of the Department of Justice for additional funds of Rs 9,749 crores: ‘The Commission in its report has

endorsed the proposal of the Department and urged State Governments to use the additional fiscal space provided

by the commission in the tax devolution to meet such requirements.’5

The Planning Commission had also instituted certain centrally sponsored

schemes to augment the resources of the state governments with respect to judiciary, such as the e-Courts

Project, which envisages computerisation of district and subordinate courts across the country. During the 12th

Five Year Plan period (2012–2017), Rs 1,670 crores was budgeted for this

project.6

Manpower Requirements

Manpower cost forms 70–80 per cent of the expenditure of the

judiciary.7 However, in respect of all posts, including judges,

there is a yawning gap between the number sanctioned and actual appointments. This vacancy has persisted for a

long time. The Law Commission’s 120th report was the first to raise the red flag

on this topic.8 It remarked in paragraph 4 of its report:

79[T]he relevant questions are as follows:

79[T]he relevant questions are as follows:

(a) On what principles since independence, have questions been taken concerning the

appropriate strength in each cadre of the judiciary?

(b) Have these principles or norms ever been publicly articulated?

(c) Have they changed over the last four decades, and, if so, through what kind of

discourse?

The 127th Law Commission Report provided further details of how

sanctioning of additional manpower requirements needs to be rationalised and appointments need to be made in

time.9 However, the position has not changed much since

then.

A significant outcome expected from a budgeting process is the plan for additional resources required

in the future. The public discourse on judicial manpower requirements is fixated

with the number of judges, without considering the fact that more judges would need more support staff for them

to function efficiently and effectively. An attempt at understanding manpower requirements should also factor in

how increased use of technology would change the human resource requirements both quantitatively and

qualitatively.

The persistence of manpower shortage and the lack of funding form a perfect vicious cycle — one reason

for vacancies is lack of funds, and adequate funds are not allocated because budgeting is done based on manpower

cost likely to be incurred. There is a clear need for change in the budgeting practices and planning to get out

of this cycle.

Outlay versus Outcome

While there is no denying the need for increased allocation towards court infrastructure and court staff, there is a need to

balance this with outcomes. The examples that follow suggest lines of inquiry that could be followed in

analysing expenditure on the judiciary. A deeper analysis needs to be carried out to measure the impact of

quantum and nature of expenditure with efficiency of the judiciary.

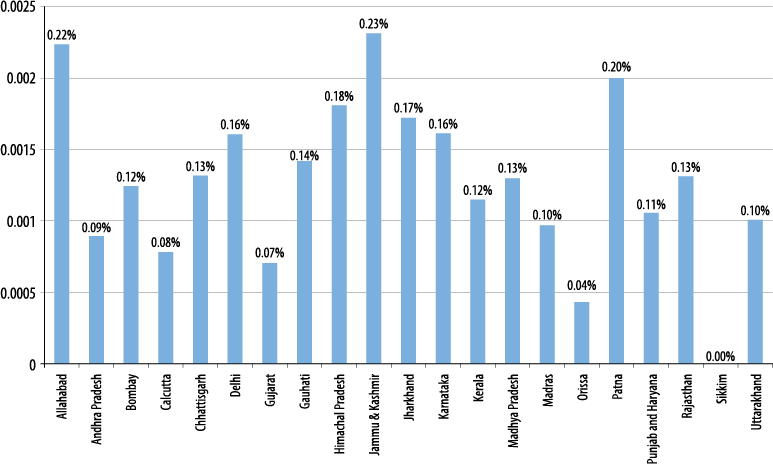

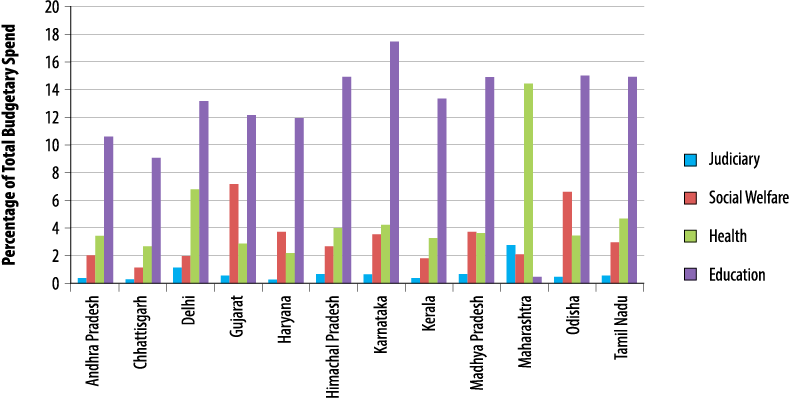

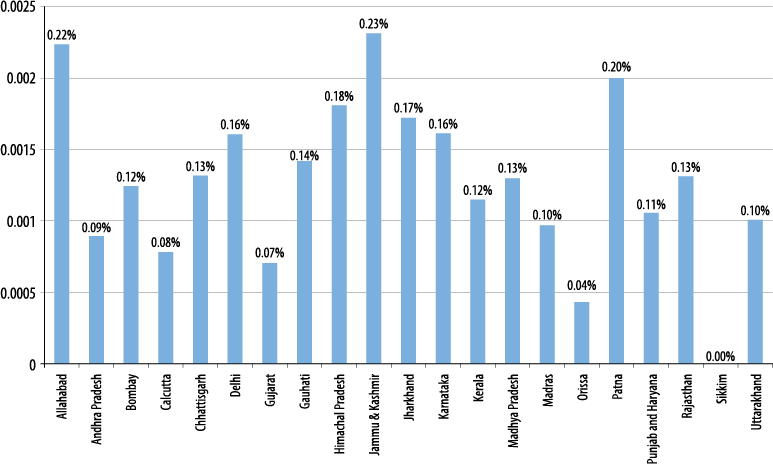

The following figures depict expenditure on the judiciary across states. Information in respect of

each state have been grouped to include jurisdictional High Courts and Benches. For example, Bombay includes

Maharashtra, Goa, and Daman and Diu.

Figure 3 shows the average budgetary allocation of states towards the

judiciary during 2013 and 2014 as a percentage of net state domestic product (NSDP) at current prices. As is

apparent, most states allocate in the same range, between 0.10 per cent and 0.20 per cent.

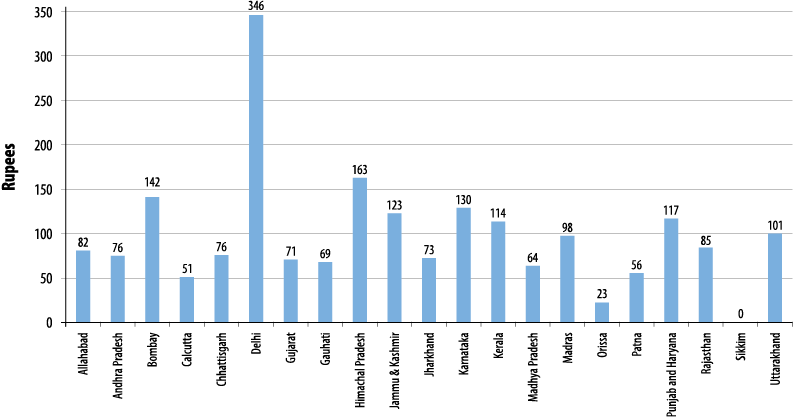

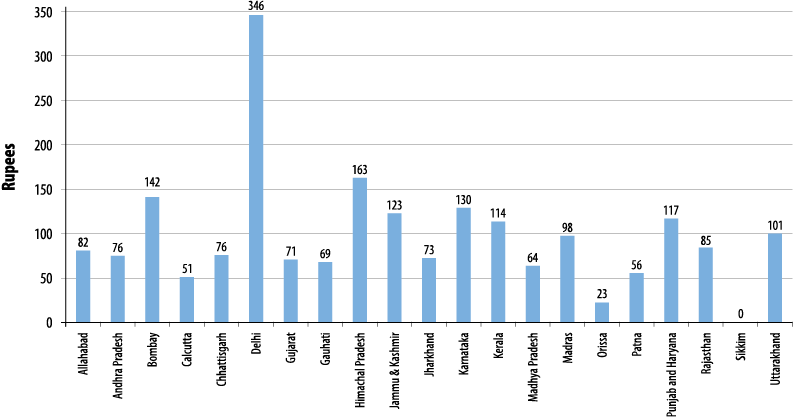

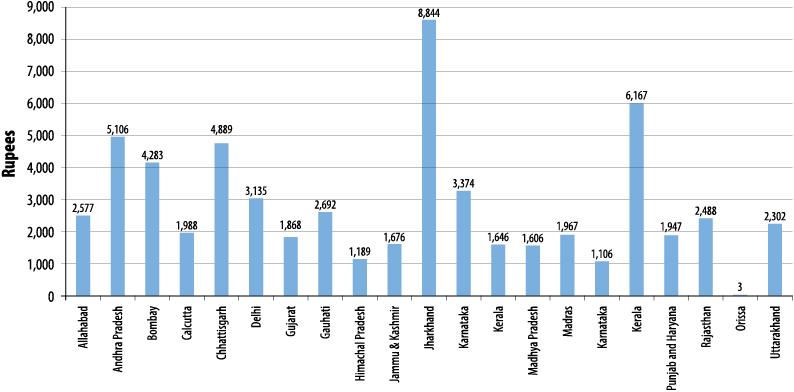

Figure 4 compares per capita expenditure on judiciary. Most states spend

between Rs 50 and Rs 150 per person on an average per year. Figure 5 depicts average expenditure by various

states per case. Most states spend between Rs 1,600 and Rs 2,700 per case per year on average.

80FIGURE 3. Expenditure on Judiciary as a Percentage of

NSDP

80FIGURE 3. Expenditure on Judiciary as a Percentage of

NSDP

Source: Annexure II to the Agenda for the Ninth Meeting of the Advisory Council of the

National Mission for Justice Delivery and Legal Reforms accessed at http://doj.gov.in/sites/default/files/Minutes-Ninth-Meeting.pdf. NSDP

figures are from India Public Finance Statistics released by Ministry of Finance.

Note: Average expenditure (gross of fees and fines) and NSDP during 2013 and 2014 is

considered.

FIGURE 4. Expenditure on Judiciary (Per Capita)

Source: Annexure II to the Agenda for the Ninth Meeting of the Advisory Council of the

National Mission for Justice Delivery and Legal Reforms accessed at http://doj.gov.in/sites/default/files/Minutes-Ninth-Meeting.pdf.

Notes: (i) Average expenditure (gross of fees and fines) during 2013 and 2014 is

considered. (ii) Population figures are as per 2011 census.

81FIGURE 5. Expenditure on Judiciary (Per

Case)

81FIGURE 5. Expenditure on Judiciary (Per

Case)

Source: Annexure II to the Agenda for the Ninth Meeting of the Advisory Council of the

National Mission for Justice Delivery and Legal Reforms accessed at http://doj.gov.in/sites/default/files/Minutes-Ninth-Meeting.pdf.

Information relating to cases filed and disposed are from the Supreme Court’s Court News, Volume VII, Issues 3

and 4, Volume VIII, Issues 1–4, and Volume IX, Issues 1 and 2.

Notes: (i) Average expenditure (gross of fees and fines) during 2013 and 2014 is

considered; (ii) ‘Case’ refers to the average of the number of cases filed and disposed of during these

two years.

Conclusion

Budget preparation practices need to consider improvement in operational efficiency and capital

expenditure requirements in order to be effective. The administrative capacity of the judiciary with respect to

budget-making needs to be enhanced. From the annual financial statements released

by state governments, it is not possible to analyse the quantum of expenditure on modernisation,

computerisation, upgradation, and expansion, and more detailed disclosures need to be made. This assumes even

more significance as the 14th Finance Commission has put the onus on state

governments for making budgetary allocation to the judiciary. Given the enormous social impact of the operation

of the judiciary, the High Courts and the Law Ministry should consider the idea of transparent budget-making

process based on public inputs and presenting the same separately from the general budget. This would also

assuage any concerns about the independence of the judiciary from a financial perspective.

The quantum of allocation needs to be increased to accommodate increasing manpower and information technology–related infrastructure needs. There is also a need for

further detailed study on the exact reasons for the varying levels of efficiency of the different courts and how

the nature and quantum of budgetary support affects them.

82Notes

82Notes

1. NCMSC. 2012. National Court Management System:

Policy and Action Plan. New Delhi: Supreme Court of India, p. 44. Available online at http://supremecourtofindia.nic.in/ncms27092012.pdf (accessed on 4 April

2016).

2. Remuneration for judicial support staff in the

lower courts and the High Courts is as determined by the Pay Commissions in each state, and by the Central Pay

Commission for staff in the Supreme Court.

3. Law Commission of India. 1988. One Hundred

Twenty-Seventh Report on Resource Allocation for Infra-structural Services in Judicial Administration.

New Delhi: Government of India, p. 16. Available online at http://lawcommissionofindia.nic.in/101-169/Report127.pdf (accessed on 4

April 2016).

4. Department of Justice, Ministry of Law and

Justice. 2011. Improving Justice Delivery: Ready Reckoner on Thirteenth Finance Commission Grant, Government

Orders and Guidelines Issued by the Government of India. New Delhi: Government of India. Available

online at http://doj.gov.in/sites/default/files/READY%20RECKONER%20TFC%281%29_5.pdf

(accessed on 7 April 2016).

5. Department of Justice. 2015. ‘Memorandum of the

Department of Justice’, available online at http://doj.gov.in/sites/default/files/Memo-Justice-Sector.pdf (accessed on

7 April 2016).

6. Department of Justice, Ministry of Law and

Justice. 2011. Report of the Working Group for the Twelfth Five Year Plan (2012–2017). New Delhi:

Government of India. Available online at http://planningcommission.gov.in/aboutus/committee/wrkgrp12/wg_law.pdf

(accessed on 4 April 2016).

7. Law Commission of India. 1987. Manpower

Planning in Judiciary: A Blueprint. New Delhi: Government of India, pp. 6–7. Available online at http://lawcommissionofindia.nic.in/101-169/Report120.pdf (accessed on 4

April 2016).

8. Law Commission, Manpower Planning.

9. Law Commission, Resource Allocation for

Infrastructural Services.

75chapter provides an overview of the budgetary process followed in the allocation of funds to the judiciary, a

comparative analysis of allocation by states on the judiciary and other social sectors, and statistical analysis

of judicial expenditure across different states.

75chapter provides an overview of the budgetary process followed in the allocation of funds to the judiciary, a

comparative analysis of allocation by states on the judiciary and other social sectors, and statistical analysis

of judicial expenditure across different states.